Speculators Control Oakland Housing Market

Oct 5, 2013

Posted in Community, Housing/Foreclosures

By Tanya Dennis

Existing home sales in the past 24 months have been heavily driven by speculators, private equity funds and hedge funds buying up huge blocks of foreclosed and distressed homes in Oakland.

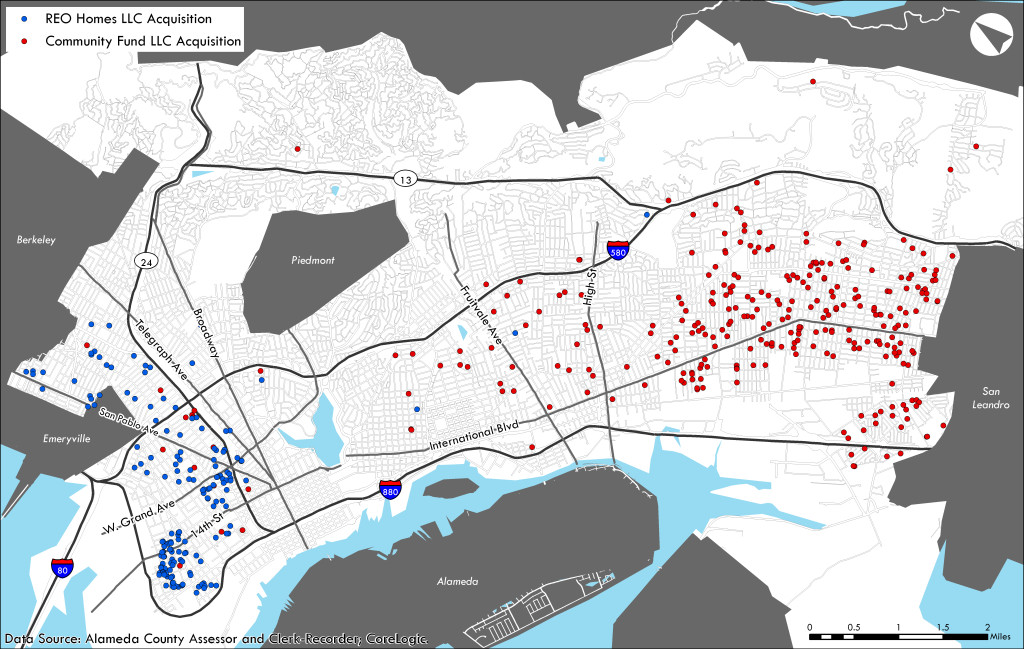

Neil Sullivan owner of REO Homes has purchased over 250 homes in West Oakland, and Richard Marr of Community Fund LLC has purchased over 307 foreclosed homes and apartments.

Speculators have purchased nearly half of the foreclosed properties in Oakland.

Oakland is leading the national trend, where speculators control the housing market. Currently Oakland is number two in the nation for the high cost of home rentals currently on the market, second only to San Francisco.

Neil Sullivan (blue dots), owner of REO Homes, has purchased over 250 homes in West Oakland, and Richard Marr (red dots) of Community Fund LLC has purchased over 307 homes.

The pattern Oakland follows the national trend, with speculators controlling the housing market.

“They swarmed the distressed housing market, buying thousands of foreclosed properties and pushing prices higher faster than anyone expected,” said Diane Olick at Realty Check.

“Now investors are pulling back, dissuaded by the higher prices they themselves brought about.”

Banks have created fake demand by lending cheap money to financial speculators. According to Business Insider, “We now have an all-time high level of investor activity, reaching 30 percent of all re-sales in the markets we track and 45 percent in markets such as Orlando, Florida.”

Speculators are creating a false perception that the housing market is recovering. Mortgage applications have dropped for seven straight weeks, refinance activity is down 57 percent, and refinanced homes are at a two-year low having slipped another 4 percent in July.

With home ownership at an 18-year low, and as 30 year fixed mortgage rates increase to 4.58 percent, potential homebuyers are holding off on purchasing a home.

According to the Wall Street Journal, “First-time home buyers, long a key underpinning of the housing market, are increasingly getting left behind in the real-estate recovery.”

First-time buyers usually account for between 40 percent and 50 percent of home sales. In June, first-time buyers accounted for 29 percent of purchased homes compared to 32 percent a year ago according to the National Association of Realtors.

“First-time home buyers are scarce because the economy stinks. Wages are falling, unemployment is high, and 40 percent of traditional first time home buyers are so loaded with debt from student loans they’ll never enter the middle class,” said Mike Whitney, who writes for the website Counterpunch.

“The fundamentals which supported strong housing markets of the past no longer exist . . .the upward distribution of wealth has widened the chasm between the nation’s rich and poor, which has weakened demand creating conditions for a long-term and irreversible slump,” he said.

According to David Kranzler of Seeking Alpha, “There are other signs that the housing market has topped out, like the reappearance and preponderance of home “flipping” and the expanded use of subprime mortgages and adjustable rate mortgages (ARMs). The primary drivers of the market for existing home sales are rapidly deteriorating.”

A new housing bubble has been created. Some economists anticipate that housing prices will fall as speculators leave the housing market before the market sours.